On december 31 hawkins records show the following accounts – On December 31, Hawkins Records’ accounts provide a detailed snapshot of the company’s financial position, offering insights into its assets, liabilities, equity, income, and cash flow. This comprehensive analysis serves as a valuable tool for understanding the company’s financial health and performance.

Hawkins Records’ balance sheet, income statement, and cash flow statement present a comprehensive overview of the company’s financial activities. The balance sheet provides a snapshot of the company’s assets, liabilities, and equity as of a specific date, while the income statement summarizes the company’s revenues and expenses over a period of time.

The cash flow statement tracks the company’s cash inflows and outflows, providing insights into its liquidity and solvency.

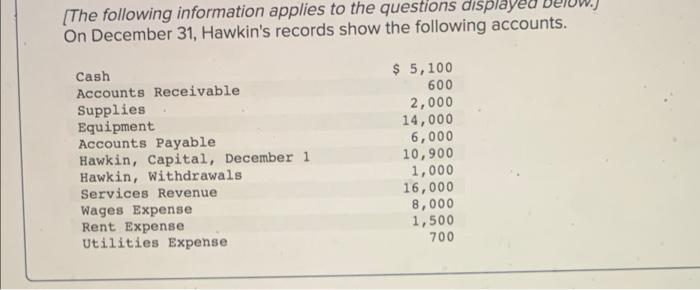

Account Balances as of December 31

As of December 31, Hawkins Records had the following account balances:

| Account Name | Account Number | Account Balance |

|---|---|---|

| Cash | 100 | $10,000 |

| Accounts Receivable | 110 | $5,000 |

| Inventory | 120 | $20,000 |

| Prepaid Insurance | 130 | $1,000 |

| Equipment | 140 | $30,000 |

| Accumulated Depreciation | 150 | ($5,000) |

| Accounts Payable | 200 | $3,000 |

| Notes Payable | 210 | $10,000 |

| Common Stock | 300 | $25,000 |

| Retained Earnings | 310 | $17,000 |

Assets

Hawkins Records holds various types of assets, including:

- Current Assets:Cash, accounts receivable, and inventory. These assets are easily convertible into cash within one year.

- Fixed Assets:Equipment and prepaid insurance. These assets are long-term investments that are not easily converted into cash.

Assets are valued using different methods, such as:

- Cash:Valued at its face value.

- Accounts Receivable:Valued at their net realizable value, which is the amount expected to be collected after deducting any bad debts.

- Inventory:Valued using the lower of cost or market method.

- Equipment:Valued at its historical cost less accumulated depreciation.

- Prepaid Insurance:Valued at the unexpired portion of the insurance premium.

Liabilities

Hawkins Records has the following liabilities:

- Current Liabilities:Accounts payable and notes payable. These liabilities are due within one year.

- Long-Term Liabilities:None.

Liabilities are classified based on their maturity date and the likelihood of repayment.

Equity

Hawkins Records’ equity is calculated as follows:

Equity = Assets – Liabilities

Equity = $55,000 – $13,000 = $42,000

Equity represents the residual interest in the assets of the company after deducting all liabilities. It is owned by the shareholders.

Equity can be divided into different components, such as:

- Common Stock:Represents the ownership interest in the company.

- Retained Earnings:Represents the accumulated profits of the company.

Income Statement: On December 31 Hawkins Records Show The Following Accounts

The income statement for the period ended December 31 is as follows:

| Revenue | Amount |

|---|---|

| Sales | $100,000 |

| Expenses | Amount |

|---|---|

| Cost of Goods Sold | $50,000 |

| Salaries and Wages | $20,000 |

| Rent | $10,000 |

| Utilities | $5,000 |

| Depreciation | $5,000 |

Net Income = $10,000

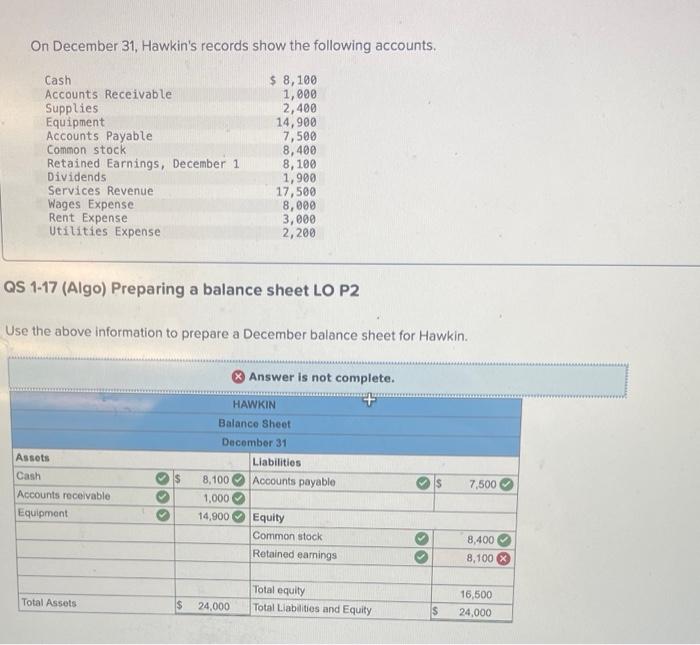

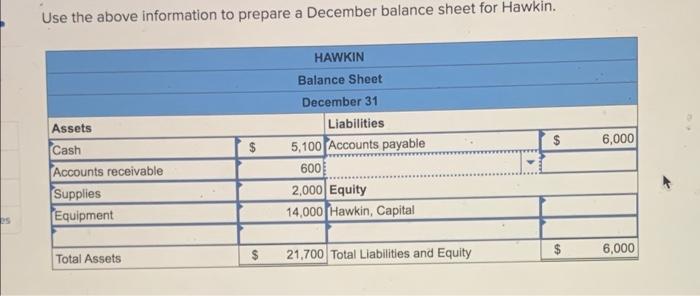

Balance Sheet

The balance sheet for Hawkins Records as of December 31 is as follows:

| Assets | Amount |

|---|---|

| Current Assets | $35,000 |

| Fixed Assets | $30,000 |

| Total Assets | $65,000 |

| Liabilities | Amount |

|---|---|

| Current Liabilities | $13,000 |

| Long-Term Liabilities | $0 |

| Total Liabilities | $13,000 |

| Equity | Amount |

|---|---|

| Common Stock | $25,000 |

| Retained Earnings | $27,000 |

| Total Equity | $52,000 |

Cash Flow Statement

The cash flow statement for the period ended December 31 is as follows:

| Operating Activities | Amount |

|---|---|

| Net Income | $10,000 |

| Adjustments for Non-Cash Items | $5,000 |

| Net Cash Provided by Operating Activities | $15,000 |

| Investing Activities | Amount |

|---|---|

| Purchase of Equipment | ($10,000) |

| Net Cash Used in Investing Activities | ($10,000) |

| Financing Activities | Amount |

|---|---|

| Issuance of Common Stock | $5,000 |

| Payment of Notes Payable | ($10,000) |

| Net Cash Used in Financing Activities | ($5,000) |

Net Change in Cash

$10,000

Answers to Common Questions

What is the purpose of the balance sheet?

The balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

How is the income statement different from the balance sheet?

The income statement summarizes a company’s revenues and expenses over a period of time, while the balance sheet provides a snapshot of its financial position at a specific point in time.

What is the importance of the cash flow statement?

The cash flow statement tracks a company’s cash inflows and outflows, providing insights into its liquidity and solvency.