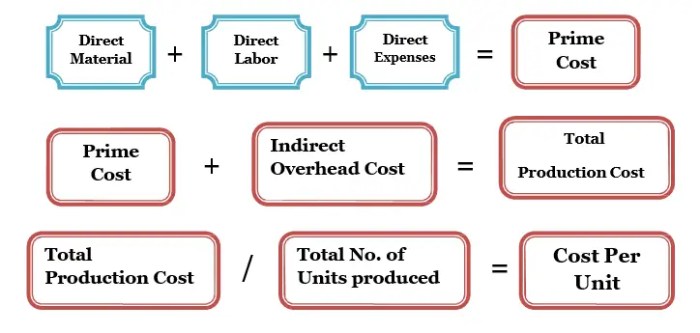

Which of the following statements is true regarding absorption costing? This question delves into the complexities of absorption costing, a fundamental concept in cost accounting that plays a crucial role in inventory valuation, financial reporting, and decision-making. Absorption costing allocates both variable and fixed manufacturing overhead costs to produced units, providing a comprehensive view of product costs.

Understanding the nuances of absorption costing is essential for accountants, financial analysts, and business leaders seeking to optimize financial performance and make informed decisions.

Absorption costing finds widespread application in various industries, including manufacturing, construction, and healthcare. By incorporating fixed overhead costs into product costs, absorption costing ensures that these costs are recognized in the periods in which the related products are produced, providing a more accurate representation of product profitability and inventory valuation.

Absorption Costing: Which Of The Following Statements Is True Regarding Absorption Costing

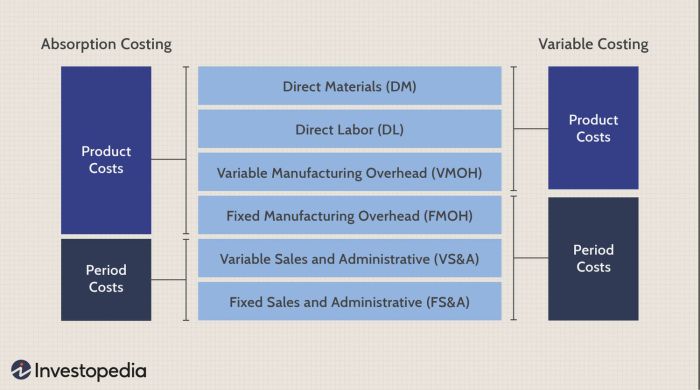

Absorption costing is a method of accounting that assigns all manufacturing costs, both variable and fixed, to the units produced. This is in contrast to variable costing, which only assigns variable manufacturing costs to the units produced.

Inventory Valuation under Absorption Costing

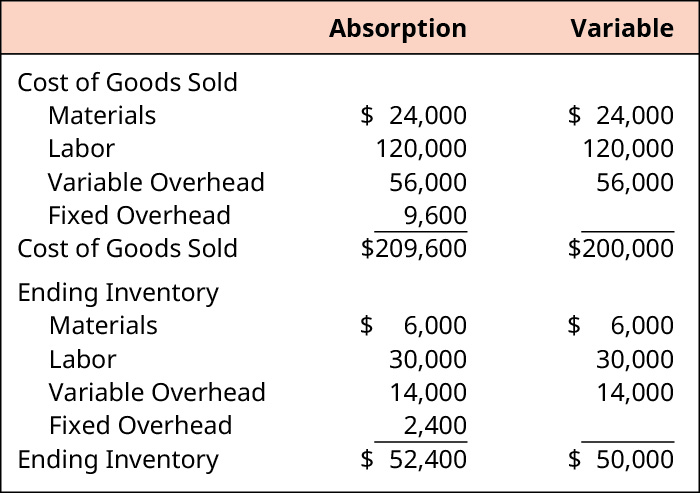

Under absorption costing, inventory is valued at the full cost of production, which includes both variable and fixed manufacturing costs. This is in contrast to variable costing, which values inventory at the variable cost of production.

Financial Statement Impact, Which of the following statements is true regarding absorption costing

Absorption costing can have a significant impact on the financial statements. For example, absorption costing can result in higher reported net income than variable costing in periods of increasing production, and lower reported net income in periods of decreasing production.

Advantages and Disadvantages

Advantages of Absorption Costing

- Provides a more accurate picture of the cost of production.

- More widely accepted by financial institutions and investors.

- Easier to implement than variable costing.

Disadvantages of Absorption Costing

- Can result in inventory overvaluation in periods of decreasing production.

- Can make it difficult to compare financial results across companies that use different costing methods.

- Can lead to inaccurate decision-making if fixed costs are not properly allocated.

International Considerations

Absorption costing is the most widely used costing method in the world. However, there are some countries that allow or require the use of variable costing. For example, variable costing is allowed in the United States under certain circumstances.

Comparison to Variable Costing

| Characteristic | Absorption Costing | Variable Costing |

|---|---|---|

| Cost Allocation | All manufacturing costs are assigned to units produced. | Only variable manufacturing costs are assigned to units produced. |

| Inventory Valuation | Inventory is valued at the full cost of production. | Inventory is valued at the variable cost of production. |

| Financial Reporting | Can result in higher reported net income than variable costing in periods of increasing production, and lower reported net income in periods of decreasing production. | Results in a more stable reported net income than absorption costing. |

Popular Questions

What is the primary purpose of absorption costing?

Absorption costing aims to determine the total cost of producing a unit of product, including both variable and fixed manufacturing overhead costs.

How does absorption costing impact inventory valuation?

Absorption costing capitalizes fixed manufacturing overhead costs as part of inventory costs, resulting in higher inventory values compared to variable costing.

What are the advantages of using absorption costing?

Absorption costing provides a more comprehensive view of product costs, reduces the impact of production volume fluctuations on profitability, and aligns with generally accepted accounting principles (GAAP).

What are the disadvantages of absorption costing?

Absorption costing can lead to overstated inventory values during periods of low production, and it may not accurately reflect the short-term profitability of products.